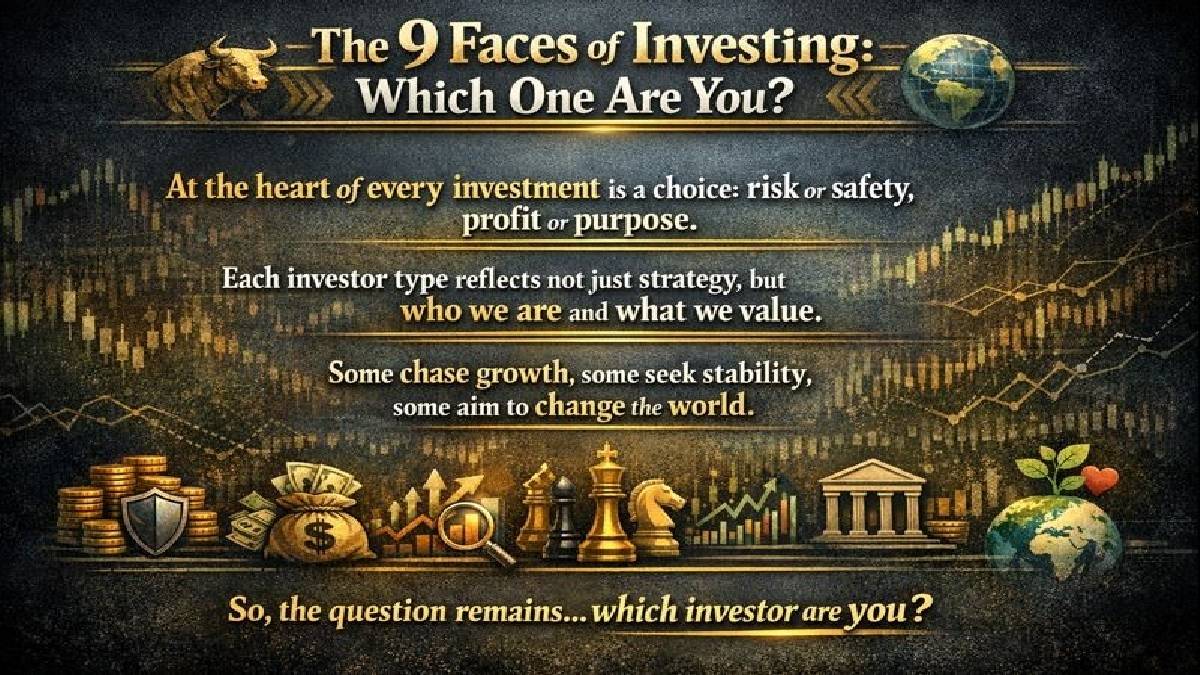

Investing extends well beyond purchasing stocks, bonds or real estate, too. It’s more like a kind of a reflection of our priorities, values and risk appetite. Because while much of the way most of us invest is to try to make a buck, how we invest and why we do so defines the kind of investor we are.

The Preservation Investor

Focus: Protecting Capital

These investors protect their fortunes as though it were a fortress. Safety is everything. They avoid bets that can lead to trouble, they also prefer safe assets like government bonds, fixed deposits or gold. “I will not lose what I have earned,” they say.

The Income Investor

Focus: Cash Flow

Income investors need steady returns. Their strategy is fed by dividend income, interest and rental income. For them, steady cash flow matters more than huge jumps.

The Growth Investor

Focus: Future Upside

Growth investors chase potential. They embrace volatility now in return for the prospect of huge rewards tomorrow. They see opportunity where others see risk. “The bigger the risk, the higher the potential reward.”

The Value Investor

Focus: Mispricing

Value investors are market hunters. They purchase what others miss and believe the real value will be acknowledged. For them, patience is power.

The Speculative Investor

Focus: Asymmetric Bets

High-risk and high-reward opportunities are what drives bold and daring, speculative investors. From start-ups to cryptocurrencies, they are betting, knowing the stakes are high — and the rewards so high.

The Strategic Investor

Focus: Positioning & Leverage

These are those investors who think beyond dollars and cents. They are informed by influence, control, and access. They don’t merely play the game; they shape it.

The Institutional Investor

Focus: Systems & Control

Disciplined, structured and scale-driven, institutional investors treat like well-oiled machines, with risk management, cycles and systems determining their approach.

The Momentum Investor

Focus: Trends & Market Sentiment

Momentum investors ride the trends of the market. They’ve used timing and sentiment as their instruments. They are following the crowd — but with a strategy, not blind luck.

The Social / Impact Investor

Focus: Purpose & ESG

The newest breed invests with conscience. They desire profit and meaning, which is why they devote their finances to social or environmental effect. “My money should do good in the world,” they think.

Bottom Line

Nine types of investors. Nine priorities. Nine ways to look at the same market. Some protect personal wealth, some pursue growth, some wager on trends, some just want to make an impact.

The bottom line — cautious or unafraid, patient or rash — is one thing — investing is a mirror of who we are, what we like, and what we have the guts to risk.

So what sort of investor do you … tell me?

At the heart of every investment is a choice: risk or safety, profit or purpose.

Each investor type reflects not just strategy, but who we are and what we value.

Some chase growth, some seek stability, some aim to change the world.

So, the question remains… which investor are you?

Disclaimer:

This article is for educational purposes only and does not constitute financial advice.

Investing involves risk, and readers should consult a financial advisor before making decisions.