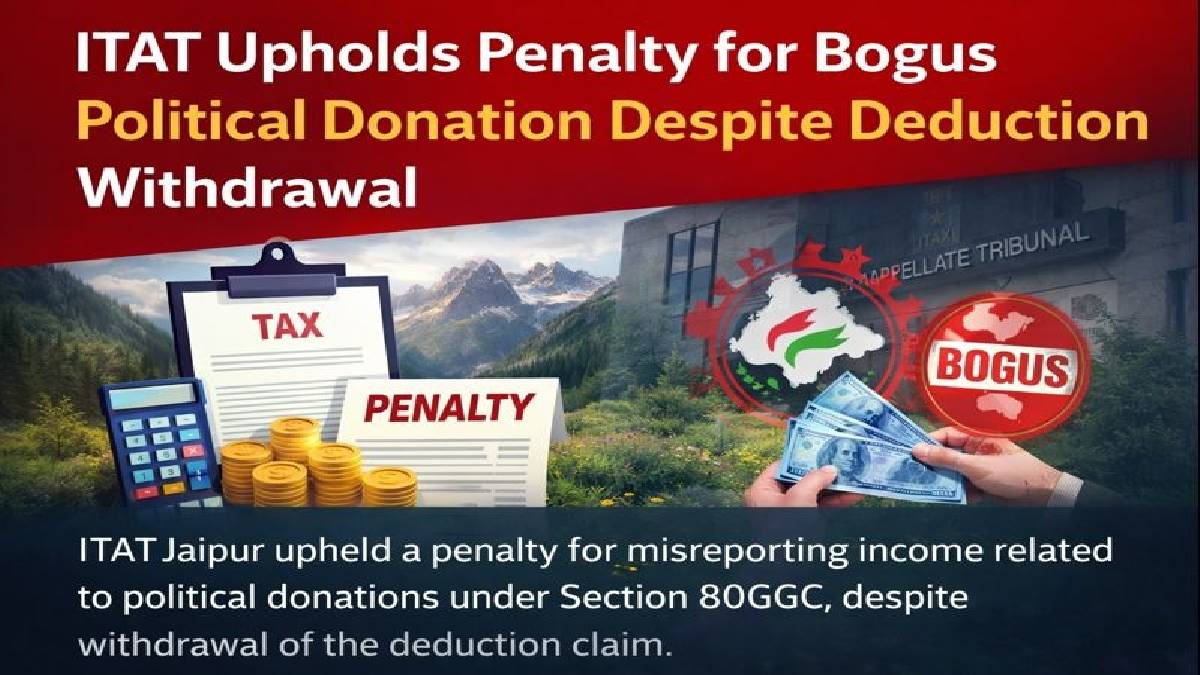

80GGC Political Donations ITAT Fines For Withdrawn Deduction

The Jaipur court of the Income Tax Appellate Tribunal (ITAT) recently upheld a penalty on a person who has misreported income payable through political donations relating to the act under Section 80GGC. The ruling is important as the penalty was carried out despite the assessee retracting the deduction claim after the assessment was reopened.

Understanding Section 80GGC

So now: Section 80GGC means taxpayers can claim a 100% deduction on donations made to registered political parties or electoral trusts. Although the provision does promote political contributions, strict compliance requirements are also mandated to limit misuse.

Case Highlights

The assessee claimed a deduction for a donation that was ultimately found to be bogus. When again the assessment was reopened, the assessee withdrew the deduction claim. That was when the ITAT stated that misreporting income could not be excused by withdrawal of the claim. The appropriate provisions imposed a penalty of 200 percent on the tax that could be evaded amounting to ₹33,280.

Section 80GGC – Claiming Deductions

Taxors owe these following the guidelines to avoid penalties:

- Acceptable Checks Only: The money sent to be remitted through cheque, demand draft, credit card, online transfer, credit card or debit card, online payment or other forms of verifiable banking can be considered only.

- Entities: Only payments to registered political parties and electoral trusts are allowed.

- You Won't Receive Monetary Support: A cash donation is strictly forbidden.

Stakeholders will also be advised to keep this documentation: receipts, bank statements, and confirmation of the registration of the political parties.

The Fallout from Wrong Claims

There can be serious consequences for making incorrect or fraudulent claims in breach of Section 80GGC:

- Penalties: 100% to 300% of the tax avoidance sought per sections 270A and 271AAC.

- It may also request evidence of donations and be a sign that such money is being used for charitable work.

- Scrutiny Notices: If you could have no proof at all.

Best Practices

To remain on schedule, and to fines:

- Confirm whether donations are from the right political party or trusted electoral party or trust before giving.

- Track all donations, including receipts and bank statements.

- Make sure to file accurate tax returns, not aggressive and unreliable declarations.

Key Takeaway

Its importance is obvious in this judgment which holds that revoking a wrong deduction claim, simply because it was wrongly reported in a certain manner, is no reason for a taxpayer to be exempt from penalties. In applying for deductions under s 80GGC the taxpayer must act on his or her duty and have good records.