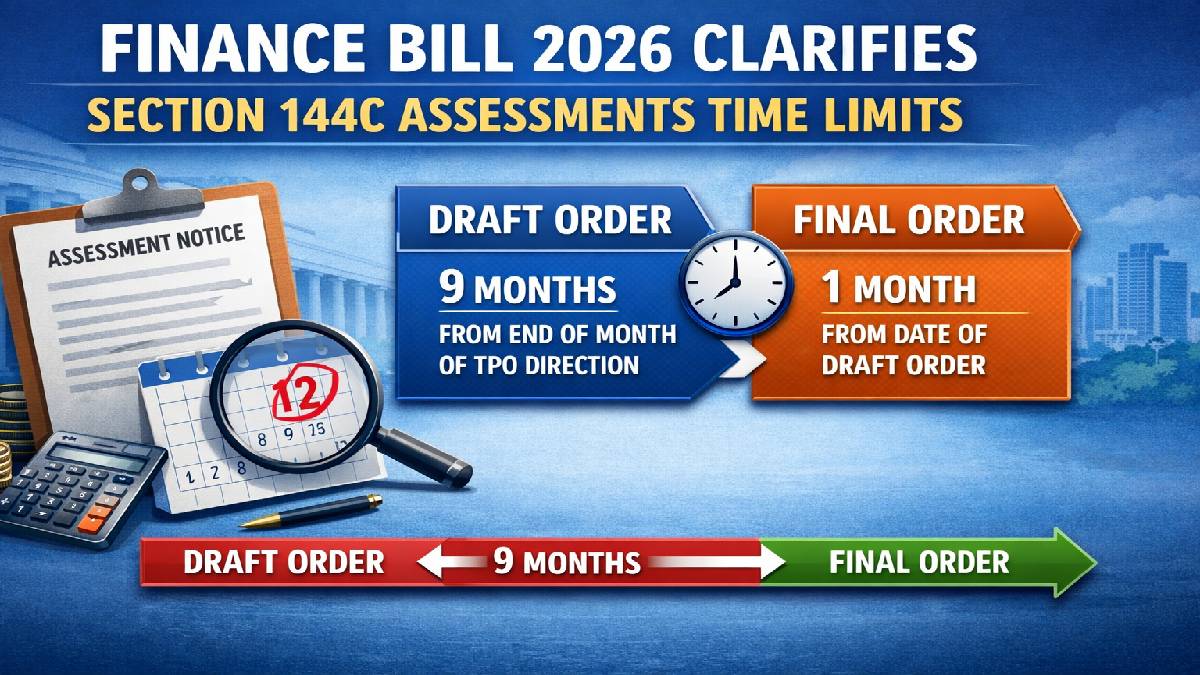

In the Income-tax Act, section 144C imposes a special procedure for the assessment of variations in a tax return arising due to transfer pricing orders or the assessee being a non-resident. The Assessing Officer (AO) submits a draft assessment order to the eligible assessee under this section, and the eligible assessee is offered 2 options under Section 144C: either accept the draft order or file an objection against the AO before the Dispute Resolution Panel (DRP).

Assessment Procedure under Section 144C

If the draft is accepted then the AO is required to make the assessment within 1 month from the end of the month in which the acceptance is received or the 30 days period for objections before the DRP expires. Section 144C(4) makes it clear that this timeline applies regardless of what is in sections 153 or 153B, and provides that if an assessee files an objection, the DRP must provide directions to it no later than nine months after the end of the month in which the draft order was forwarded (section 144C(12)).

That AO then has one month from the end of the month in which DRP instructions are received to perform the assessment (section 144C(13)), which again overrides sections 153 or 153B. Sections 153 and 153B otherwise impose timelines for regular and search-related assessments.

Judicial Interpretation

Judicial interpretation changed over time, though there was some controversy as to whether the entire section 144C process should conform with the overall bounds of sections 153 or 153B, despite explicit carve-out provision in section 144C.

This led to split verdicts under the Supreme Court, in uncertain terms.

Clarification in Finance Bill 2026

With the Income-tax Act, 2025 taking effect 1 April, 2026, the Finance Bill 2026 explains that only sections 153 and 153B govern the draft order phase, while 144C timelines apply to finalisation of assessments.

But these changes are of a retrospective nature: from 1 April 2009 for section 153 and 1 October 2009 for section 153B to ensure uniformity, eliminate possible litigations, and provide both taxpayers and authorities with some measure of certainty.