In a move that has sent shockwaves through Hollywood, Netflix has agreed to acquire the prized film and television studios and streaming division of Warner Bros. Discovery (WBD) for a monumental $72 billion in equity value (with an enterprise value of approximately $82.7 billion including debt).

The deal, announced following a weeks-long bidding war against rivals like Paramount Skydance and Comcast, is a significant departure from Netflix’s historical preference for organic growth and cements its position as an unrivaled content behemoth.

The Assets and The Price

The acquisition covers WBD's most valuable creative assets, specifically:

- Warner Bros. Film and TV Studios: One of Hollywood's oldest and most prolific studios.

- HBO Max and HBO: The premium television network and its streaming service, home to critically acclaimed hits like Game of Thrones, Succession, and The White Lotus.

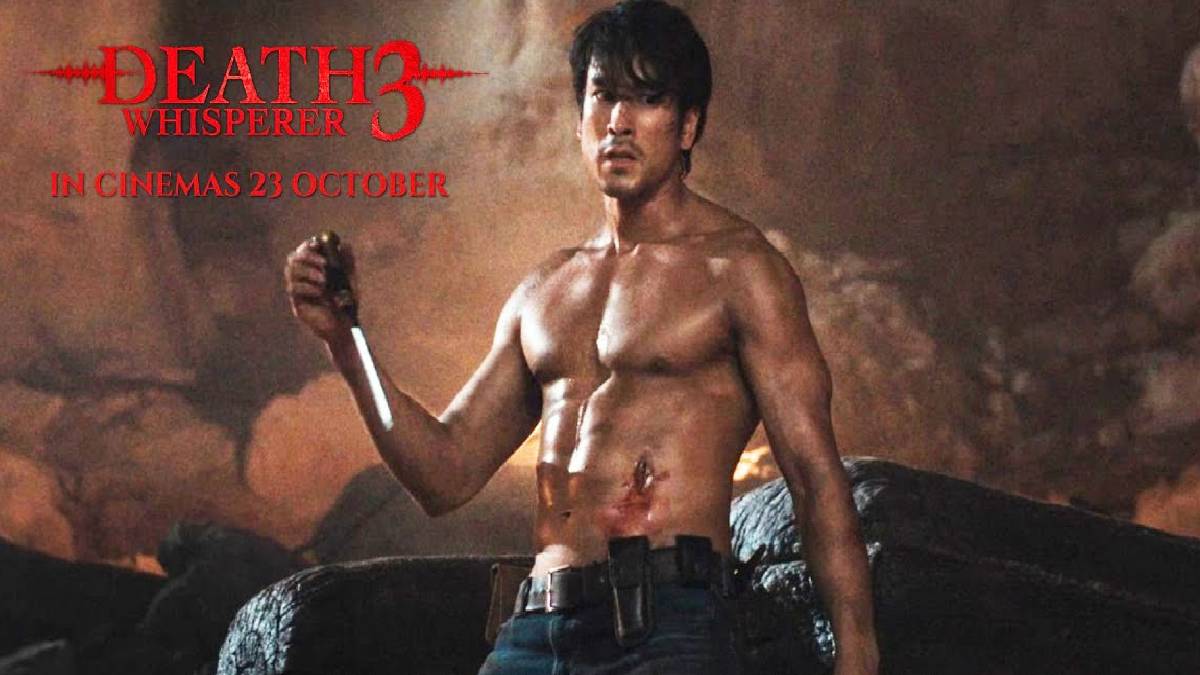

- Iconic Franchises: The acquisition hands Netflix control over massive intellectual property, including DC Comics (Batman, Superman), Harry Potter, The Lord of the Rings, and classic TV shows like Friends and The Big Bang Theory.

The transaction is structured as a cash-and-stock deal, valuing WBD's studios and streaming division at $27.75 per share.

Reshaping the Streaming Landscape

Netflix's rationale is clear: absorbing a competitor’s streaming service with nearly 130 million subscribers and gaining a century-old library of content provides a crucial advantage in the escalating streaming wars.

Co-CEO Ted Sarandos noted that combining Warner Bros.' classic and modern favorites with Netflix's own culture-defining hits like Stranger Things will "define the next century of storytelling."

Key aspects of the future structure include:

- Spin-off: The deal is expected to close after WBD completes a planned spin-off of its Global Networks division (including CNN and Discovery Channel) into a separate publicly-traded company, Discovery Global, anticipated by the third quarter of 2026.

- Cost Savings: Netflix anticipates generating at least $2 billion to $3 billion in annual cost savings by the third year after the deal closes.

- Theatrical Releases: To alleviate industry concerns, Netflix has reportedly pledged to honor Warner Bros.' existing commitment to theatrical film releases, marking a potential shift in the streamer's traditional model.

Regulatory and Industry Hurdles

Despite the unanimous approval from both company boards, the deal faces a long and arduous path to completion. It is expected to draw intense antitrust scrutiny from regulators in the U.S. and Europe, given the massive market concentration that would result from combining the world's two largest streaming subscriber bases.

- Competition Concerns: Critics, including rival executives and film industry unions, have voiced strong opposition, warning that the merger could reduce competition, potentially increase consumer prices, and severely impact the theatrical movie business.

- Breakup Fee: Netflix included a substantial $5.8 billion breakup fee to be paid to WBD if the deal collapses due to regulatory hurdles, underscoring the high-stakes nature and anticipated legal struggle.

The transaction is expected to close in late 2026, contingent upon regulatory and shareholder approval.