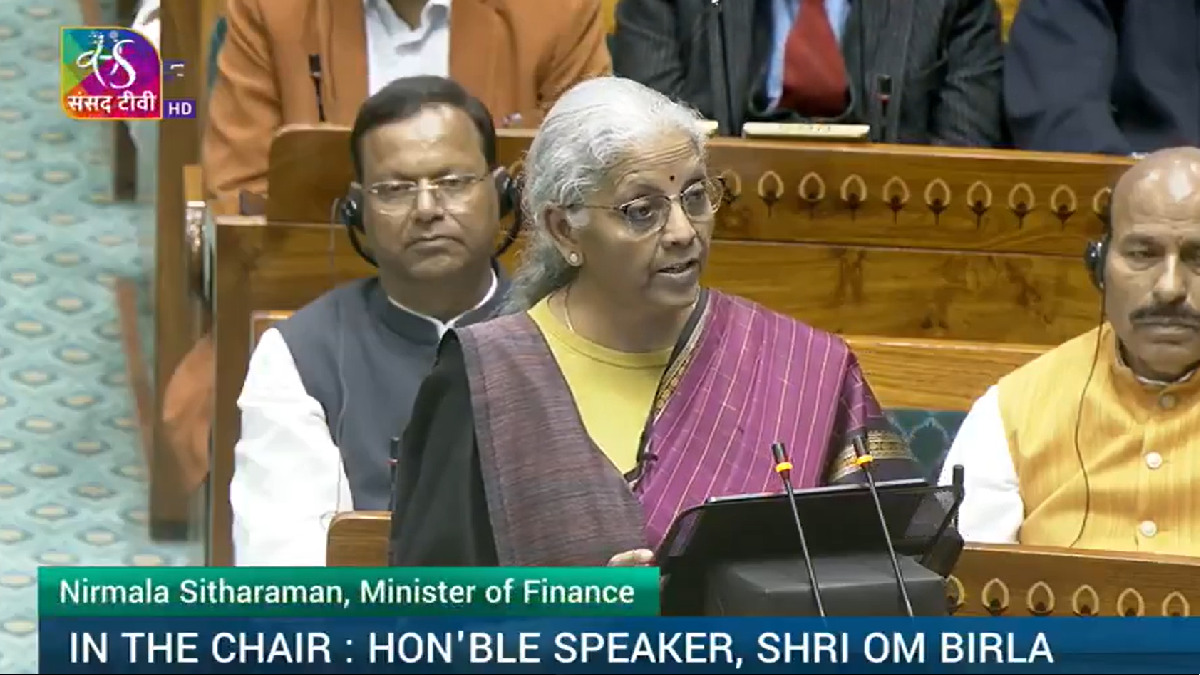

Finance Minister Nirmala Sitharaman’s ninth consecutive budget has given the middle class relief while putting the squeeze on luxury and speculative activities in a sort of “sin tax” style. The government has been focusing on healthcare and digital manufacturing by rationalizing customs duties and through reducing TCS (Tax Collected at Source).

"Green" List: What becomes cheaper

The biggest relief is coming from the healthcare and travel sectors, with huge duty cuts aimed at reducing out-of-pocket costs for families.

- Healthcare: 17 life-saving cancer drugs and medicines for 7 rare diseases have been fully exempted under Basic Customs Duty (BCD).

- Electronics: Smartphones, tablets, and microwave ovens are expected to become more affordable with the government removing duties on major components and capital goods used in domestic manufacture.

- Travel & Education: TCS on overseas tour packages and foreign education remittances has been cut from 5-20% to 2%, this greatly relieving the immediate cash liability.

- Personal Imports: The amount of the duty imposed on personal use goods (courier/post) decreased to 10%, or half of 20%.

- Clean Energy: BCD exemption for solar glass, electric vehicle battery machinery (Lithium-ion cells), capital goods for critical minerals.

- Seafood & Leather: Lower prices for raw materials for leather footwear (Shoe Uppers) and shrimp/fish feed to enhance exports.

The “Red” List: What Gets More Expensive

Many products and services will now be subject to raising levies to limit "non-essential" consumption and high-risk speculative trading.

- Stock Market Trading: The Securities Transaction Tax (STT) has increased to 0.05% on Futures and 0.15% on Options which increases the cost of F&O trading.

- Sin Goods: A comprehensive increase in the National Calamity Contingent Duty (NCCD) will hike the prices of cigarettes, bidi, and gutkha.

- Luxury Imports: Premium imported watches and alcoholic beverages will see a price hike due to duty rationalization.

- Household Items: Low-cost imported umbrellas have now faced a floor import price and higher duties to safeguard local manufacturers.

- Kitchen & Home: Coffee roasting and vending machines are going to be more expensive as the exemptions have been eliminated.

- Agriculture: If import fee exemptions are also repealed, prices could go up for some fertilizers (like ammonium phosphate).

The “Crypto” Twist

To put pressure on secrecy, the Budget also introduced a ₹200 daily penalty for undeclared crypto assets and a flat ₹50,000 fine for false statements in digital asset filings which will apply from April 1st, 2026.