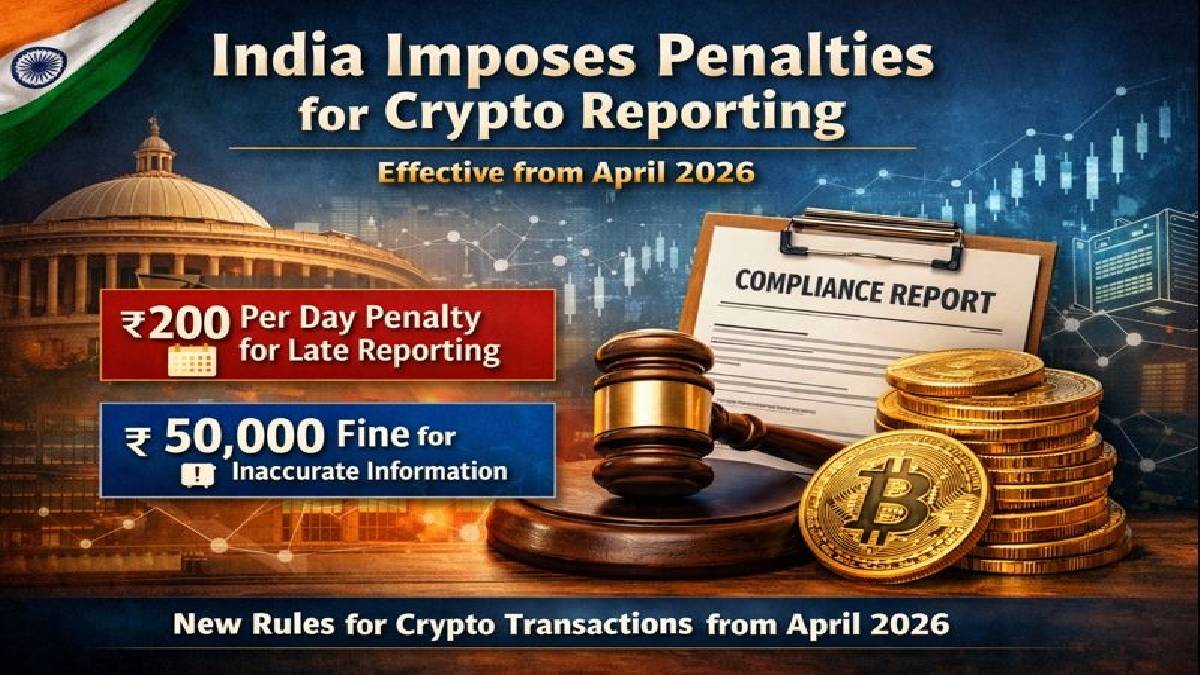

Penalties to Enforce Crypto Reporting

One thing that India would be taking into account is strong controls over crypto-asset transactions. India’s Finance Bill 2026 introduces penalties for merchants and regulators for non-compliance and incorrect reporting. The amendment, which enters force in law on 1 April 2026, is intended to add to the transparency and accountability in the volatile marketplace which has sprawled with an accelerating demand as well as a world-famous growth rate over the last few years.

Section 509 of the Income-tax Act, 2025

Section 509 of the Income-tax Act, 2025 stipulates that prescribed reporting entities have to provide reports on crypto asset transactions, which are required per the respective definitions. But there was no specific penalty for not submitting these statements or for giving false reporting information. A strong penalty structure, which would also serve as a regulatory regime, could be included in section 446, replacing section 446, and supplementing it.

New Penalty Structure

Under the new regulations, companies that do not make the required statements due will be penalised on time submission of the required statements on a daily basis for failing to submit these will incur a daily penalty of ₹200 pending the commencement of compliance, under the new rules of the new mandate/regulations, or on receiving the necessary items. This way, timely reporting is done, and delays in regulatory monitoring will be avoided.

In addition, companies which provide incorrect or nonconforming information or not carry out due diligence will attract the imposition of a fixed penalty, including a flat penalty of ₹50,000 for non-compliance, to be fixed. Those penalties would reflect India’s intention to make crypto transaction reporting more accurate and better quality.

Global Context

At the same time as the currency boom spreads itself around the world, regulators are also looking for ways to block scams and keep financial systems transparent. India’s approach mirrors this, also sending a message to both domestic and overseas players that compliance and correctness will be strictly enforced.

Scope of Amendments

The amendments apply these measures in a forward-looking manner and are in scope for all transactions reported for purposes of this amendment beginning from 1 April 2026. Reporting and reporting entities shall undertake prompt proactive steps in accordance with data reliability, prompt filing and diligence.

Not only does it ensure accountability but it also bolsters confidence in the reporting and monitoring of crypto-asset transactions – a key issue as the sector remains popular globally in the world economy.