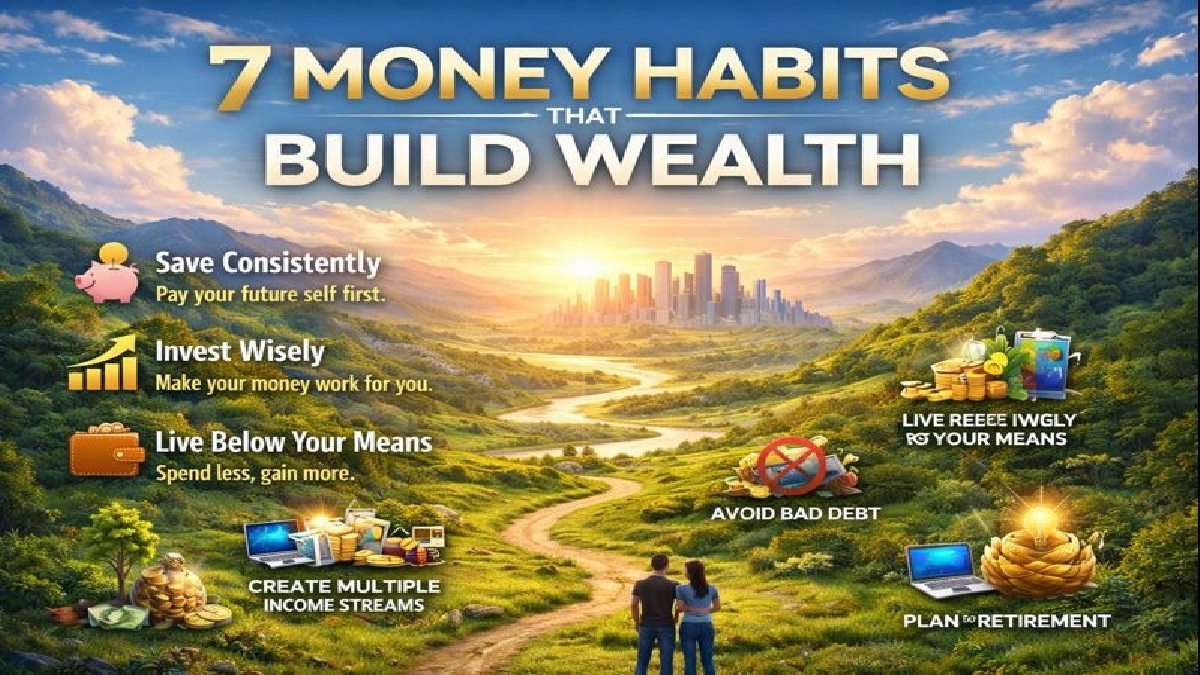

7 Money Habits That Make Wealth. More than one might become privileged with money, the privilege is not bestowed on you by only some lucky few, but that money is built by selecting what you get, following rules, and not waiting until the last minute. You can change your career path, your life, and, whatever that journey will look like no matter where you are today, the right habits can help you move forward. Little, consistent actions can produce significant, real change over time.

Save Regularly — Even Small. You don’t need a substantial income to begin wealth construction. What matters is consistency. Every dollar you save represents a promise to yourself in the future. Over time, such small efforts turn into financial security, confidence and independence. Automate your savings, and allow discipline work within you quietly.

Let Your Money Work for You. Saving safeguards you; investing increases you. When you invest smartly, your money starts working despite resting. Time, with compounding, is your greatest ally. Get on board early, keep a pulse, trust the process. Wealth increases through time in the market, not from timing the market.

Spend with Purpose, Not Pressure. Real wealth isn’t about what you show — it’s about what you keep. Living below your means gives you power: the power to save, invest, and shape one’s destiny on your terms. Every careful spending choice moves you one step closer to financial independence.

Break Free from Bad Debt. High-interest debt can erode your dreams in silence. Stripping yourself of unnecessary debt isn’t just a money decision — it’s an emotional victory. Every repayment offers you more control, more clarity and more space to improve. Choose freedom over fleeting luxury.

Create More Than One Income Stream. One income pays the bills. Multiple incomes build wealth. Side businesses, investments or passive sources of income offer a foundation of security and opportunity. As your income grows beyond your time, financial stress starts to dissipate — and confidence replaces it.

Start Planning for Retirement Now. You're not regretting your future — simply preparing for it. The earlier you prepare for retirement, the less you worry later. Compounding rewards patience and consistency. Starting now, remaining committed and, in the years to come, give yourself choice and satisfaction.

Keep Learning, Keep Growing. Success in finances is a journey, not a destination. More data than ever makes for better decisions. Knowledge removes fear and fills it with clarity. Read, ask questions and seek advice — because the best decisions lead to long-term wealth.

A Final Word. One choice at a time you build wealth. You don’t need to know everything but you do need to start. Develop these habits, be on a regular basis and trust the process. Eventually, you won't just notice the difference -- you will feel it in your confidence, security and freedom.