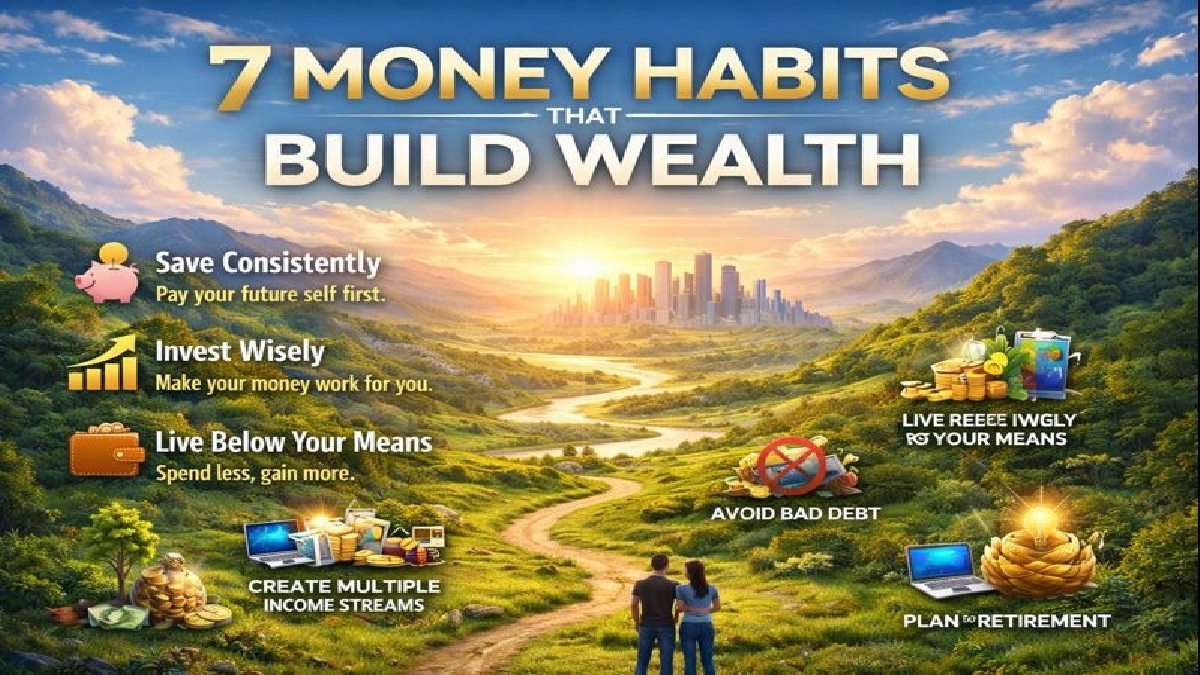

4 Key asset types the wealthy are all concerned with. Wealth-building is not just making more money; it’s investing strategically. Rich people tend to diversify their holdings to be made up of four main asset types serving different purposes for wealth development and preservation. Each type of assets has its own function.

1. Businesses. Owning businesses.

One of the most frequent sources of income for rich people is owning a business. Profitable firms can yield active income -- that is, money directly earned through direct action from your efforts and management. But building, or acquiring, great brands creates long-term value through building or buying strong brands, allowing space for opportunities to scale and sell. Not only do businesses generate profit, but they also offer leverage -- effort can generate more income than you could ever earn through your own time.

2. Real Estate.

Investing in real estate is a classic means for creating passive income. Those rental, commercial properties, or even land can all be considered. Unlike active income, passive income also comes in fairly consistently, at a low day-to-day rate once the property has been bought, rented, and managed well. Real estate too is more attractive to those looking to build up capital appreciation over a long period of time, thus it’s both an income source and a long-term investment.

3. Commodities:

Commodities include oil, gas, gold, silver and other valuable metals. Rich investors use commodities to profit from energy markets and worldwide demand with such products. They can serve as a hedge against inflation and market volatility, saving valuable money when other classes do badly. Commodities additionally offer exposure to physical goods for which there is limited supply and a unique, high-value investment that can be made.

4. Paper Assets

On the financial side, paper assets, like stocks, bonds, and index funds, help investors participate in financial markets, they get an opportunity to participate. Those assets can deliver growth, dividends and interest income. Paper assets build wealth over time via compounding returns, making money work for you as you age. Stocks have growth potential, bonds stability and index funds wide-ranging diversification.

Conclusion:

The rich don’t depend on one source of income. They tie businesses, real estate, commodities and paper assets together to generate several cash flows and pathways to wealth growth. The keys to financial success comes down to being strategically diversified and investing long-term.