How to Track Your Finances: A Simple Guide to Financial Control. Being smart about wealth is about staying in business; it doesn’t equal making more; it means controlling what you already have. Good financial tracking provides clarity, reduces stress, and fosters step by step toward financial freedom. This is the first walkthrough of the fundamental parts of personal finance and their relationship.

Understand Your Income. Income is the primary pillar of your financial life. It consists of all the money you earn including the things you make on a monthly basis, such as salaries, profits from a business, freelance work and interest, or rental income. Being precise about how much cash you receive each month means that planning can be made more judiciously. Without income tracking, budgeting is guesswork; the financial targets are vague in your plans.

Keep track of your expenses carefully. Expenses are about how your money is going. These can be rent, food supplies, utilities, transport or school or health care and entertainment. The simple formula:

- Income – Expenses = Available Money.

Savings do not appear as long as expenditure is unregulated. Tracking expenses lets you spot unneeded spending and assign funds to more significant objectives.

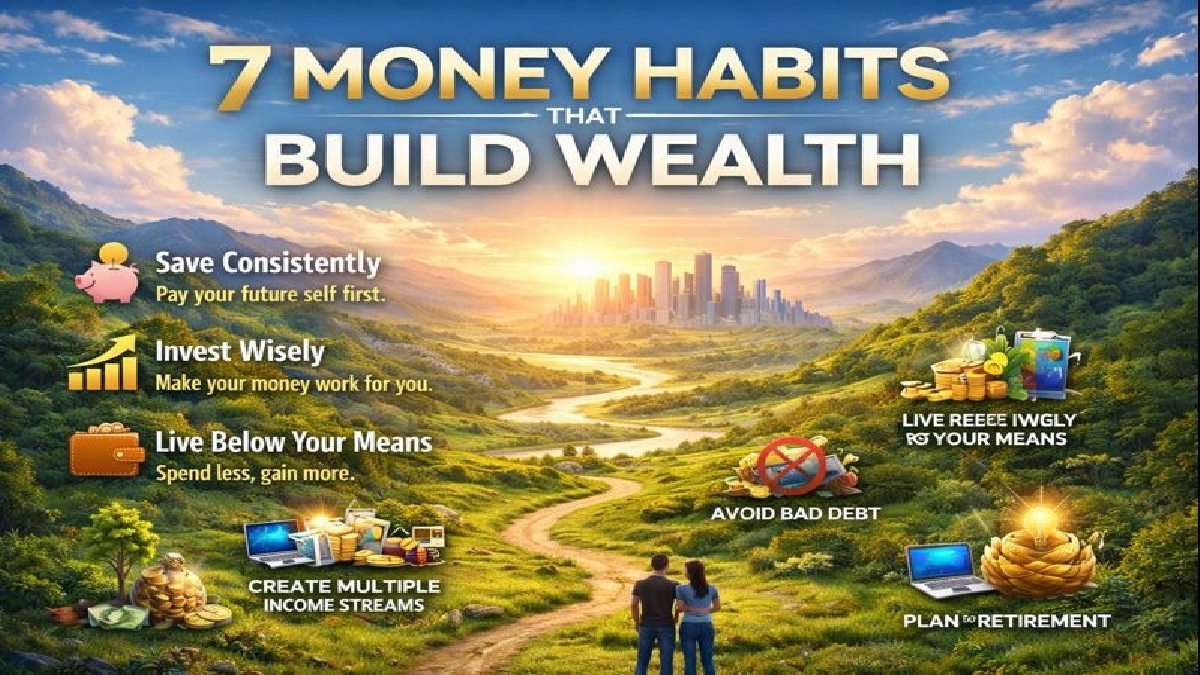

Build Strong Savings Habits. Savings are the cash saved rather than consumed. They protect you for emergencies and direct you to accomplish other things! Your Savings Rate is a good number:

- Savings ÷ Income × 100 = Savings Rate (%).

An increase in saving rate indicates more financial discipline and security. Even modest, steady savings add up to a big deal in the near-term.

Manage debts intelligently. Debt is money you owe and will have to be repaid sometime down the road. These are loans, credit cards and EMIs.

Two important indicators:

- Debt-to-Income Ratio – indicating how much of your income contributes to debt.

- Cash-to-Income Ratio – measures liquidity and repayment ability.

Excessive debt restricts financial freedom. Debt reduction helps improve cash flow and boosts your financial position.

Grow With Smart Investments. Resources are investment assets in an economic sense: mutual funds, stocks, real estate or retirement. Only on a daily basis can you strike the right balance between investment and cash. Investment contributes to building long-term wealth, but having liquid cash balance during emergencies keeps an amount of it steady during crises.

Calculate Your Net Worth. Net worth gives you a clearer picture of your financial health.

- Net Worth = Total Savings + Total Investments – Total Debt.

A net worth that is positive and increasing indicates you are moving forward financially. It is not only about what you earn, it’s also how you control and grow it.

Conclusion

You can track yourself financially and that feels like a nice habit. In learning about your income, managing your expenditure, saving regularly, cutting down on debt and investing wisely, you lead the way in your future financial future. Money is also at its best when you are tracking it — because exactly what you measure is what you can improve.