Many Indian small businesses find themselves faced with GST notices, not so much because they committed fraud — but because they just made simple mistakes.

Nowadays, computer systems and matching of data in the GST department keep the errors in sync, even if for very little in the way of human error recognition to detect. If your GST returns reflect any warning signs, your business will likely need to be selected for scrutiny, audit, or penalty.

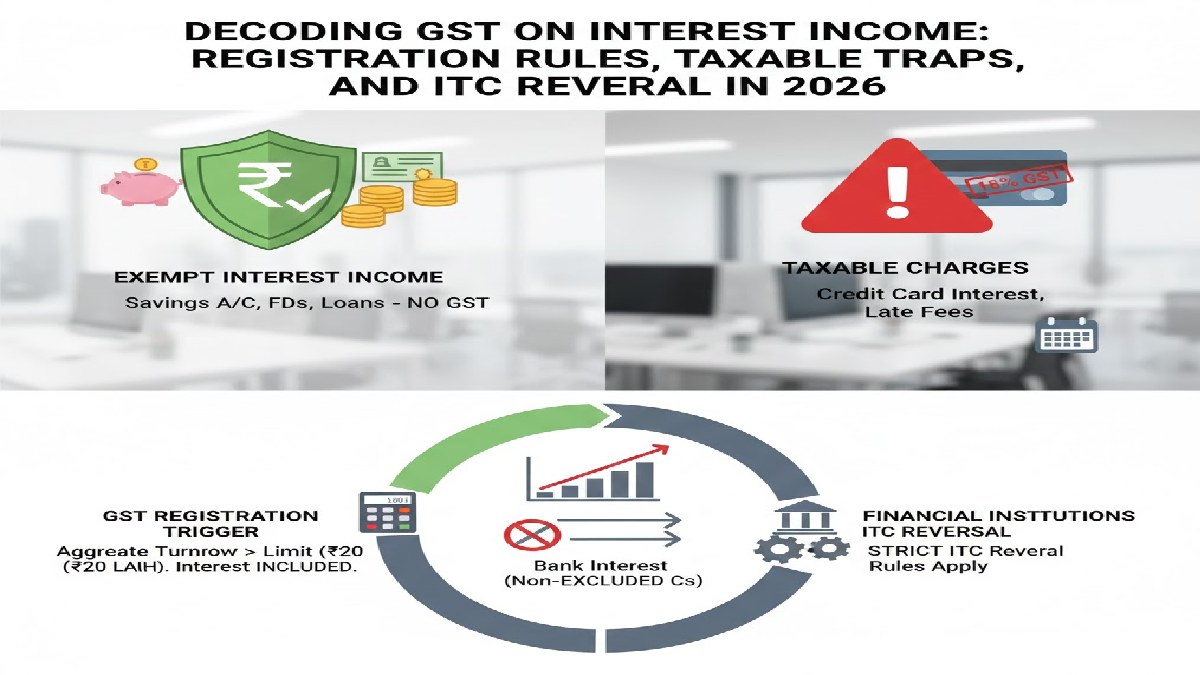

The Top 10 GST Red Flags Simple Facts. Difference Between GSTR-1 and GSTR-3B. If for example you display ₹10 lakh sales in GSTR-1 yet pay tax only for ₹8 lakh in GSTR-3B this will cause the system to flag it. Common among small traders and service providers. When Supplier Did Not File Return, You Took ITC. You say you have ITC, but the supplier did not file GSTR-1 or is non-compliant. Commonly found in kirana shops, small manufacturers, and MSMEs.

Very High ITC relative to Sales

If your purchases and ITC are strong but sales weak, that is suspicious. Example: A shop claiming ₹2 lakh ITC and only ₹3 lakh turnover. Sudden Large Change in Sales or Tax. Sales jump or fall suddenly for no reason. Example: ₹5 lakh monthly sales suddenly fall to zero.

Claim of ITC on blocked items (Section 17(5)). ITC cannot be claimed on personal vehicles, staff food expenses, or personal use items. Frequently observed in small businesses blending personal and business expenses. Filing on E-Way Bills Instead of Nil Return In E-Way Bills. If things are getting moved but you file for nil returns, that makes for a mismatch. Mostly used in logistics, wholesale and trading businesses.

Late Filing of GST Returns Repeatedly

Late entry demonstrates poor compliance with GST and increases the probability that the GST officer will follow up on the case. E-way Bills Did Not Match Turnover. E-way bills indicate high movement of goods, but turnover seen is low. You see seen in traders in iron, cement, FMCG, textiles.

Foolish or Daring GST Suppliers

If your supplier issues fake bills or is not paying tax, this is a risk for your ITC. A lot of risk when you purchasing from unknown or surprisingly low-priced vendor. Catching Big GST Refunds Without Proven Objectiveness. On export or excess ITC refunds without proper documents notices are often issued. A feature frequently seen in exporters and startups, first-time refund recipients.

Quick Advice to Avoid GST Issues

Match your books with GSTR-2B on a monthly basis. Use GST compliant suppliers only. Get your returns filed on time even in a slow month of business. Keep the invoices, e-way bills and bank records properly.

Last Message for Small Businesses

The vast majority of GST notices are avoidable. Regular checks, truthful reporting, accurate reporting, and timely filing shield businesses from penalties and pressure. The GST is easier to enforce if it is done regularly in a non-tardy manner.