India’s banking system is undergoing one more wave of consolidation. Two Indian public sector lenders being merged to strengthen public funds, viz; Union Bank of India and Bank of India are set to form a common one in the city of Mumbai with the help of the government. The measure falls under the broader banking reforms that are meant to empower state‑owned banks, enhance efficiency, and institutionalise entities to compete better with private and global rivals. The proposed merger is expected to create the second biggest public sector bank in India, in the aftermath of its creation, behind the State Bank of India (SBI).

Why the Merger Matters:

The merger is important because it will radically transform India’s public banking system. They are both large lenders with vast branch networks, millions of customers and presence in large regions. It is the government’s plan then that they pool their resources to bring the institution into an “inclusive formation able to accomplish its big projects, and provide better service and free up unnecessary duplication of activity so that they can work efficiently with less burden at the same time. This merger, in turn, could provide customers with easier access to services, a whole new suite of digital innovations, and increased branch and ATM offerings. For the banks themselves, it could translate to a more robust capital position, better risk management and a stronger position to compete with the private sector banks.

Zeroing in on Scale:

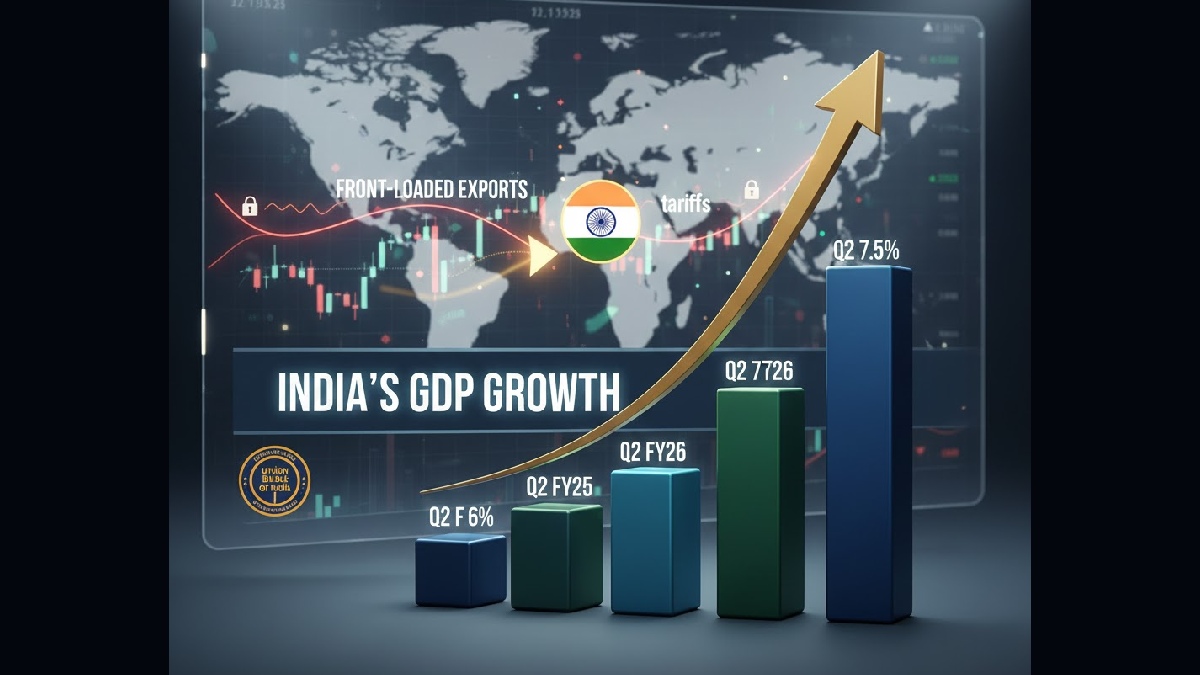

At present State Bank of India is a majority-owned public sector bank in India and occupies a dominant market position. Union Bank and Bank of India merger would form a second biggest by scale and coverage. Together, the two banks will provide a large customer base, robust deposit growth, and lending power to support India’s economic expansion. This scale matters for one simple reason: larger banks can handle larger infrastructure projects, work with industries and steady the financial system. It also shrinks the pool of smaller, flaccid banks that could find it challenging to compete in a competitive environment.

Government’s Reform Agenda:

For at least a few years now, the Indian government has pursued consolidation in the banking sector. Previous mergers, like Punjab National Bank amalgamating with Oriental Bank of Commerce and United Bank of India, formed stronger institutions. The concept is to minimize the fragmentation of public banks, and create a smaller portfolio but stronger. The government is keeping to this policy by consolidating Union Bank and Bank of India. Other mergers may also possibly be considered in the future by merging Indian Bank with Indian Overseas Bank, according to reports.

Benefits for Stakeholders:

For consumers, the merger could mean a greater convenience, better digital banking service levels and improved financial products. Employees might be able to benefit from new opportunities but also have challenges with restructure and reallocation of role. For investors and for the economy, a robust bank means greater stability, and therefore better borrowing capability and a stronger capacity to underwrite growth pillars like infrastructure, manufacturing and exports.

Challenges Ahead:

The integration also poses challenges along with many advantages. It is a challenge to integrate two major banks. However, these systems and management styles must be reconciled, along with their differences in technology. The employees at the transition may experience uncertainty, whilst customers experience temporary interruptions. There will be a need for the government and regulators to facilitate the process which has to be clear and seamless.

India’s banking reforms have seen a significant consolidation of powers like that between Union Bank of India and Bank of India under merger plans. India's efforts towards a better Public Banking System will also be through the establishment of the second largest state‑run bank, following SBI, creating institutions to help India's economic aspirations. Challenges aside, the merger is consistent with an articulated vision: less, but stronger banks that can service the nation well.