As the year 2025 draws to a close, taxpayers and citizens in India face a series of critical financial and administrative deadlines. Failing to complete these tasks by December 31, 2025, could result in heavy penalties, frozen bank accounts, or the inability to file essential documents.

With the holiday season approaching, it is easy to overlook administrative responsibilities. However, the Indian government and regulatory bodies like the CBDT and RBI have set firm year-end cut-offs for the following tasks.

1. Filing Belated or Revised ITR

If you missed the July 31 deadline for filing your Income Tax Return (ITR) for the Assessment Year 2025-26, December 31 is your final opportunity to file a Belated Return.

- Penalty: A late filing fee of up to ₹5,000 may apply (₹1,000 for income below ₹5 lakh).

- Revision: This is also the last date to file a Revised Return if you discovered errors in your original filing.

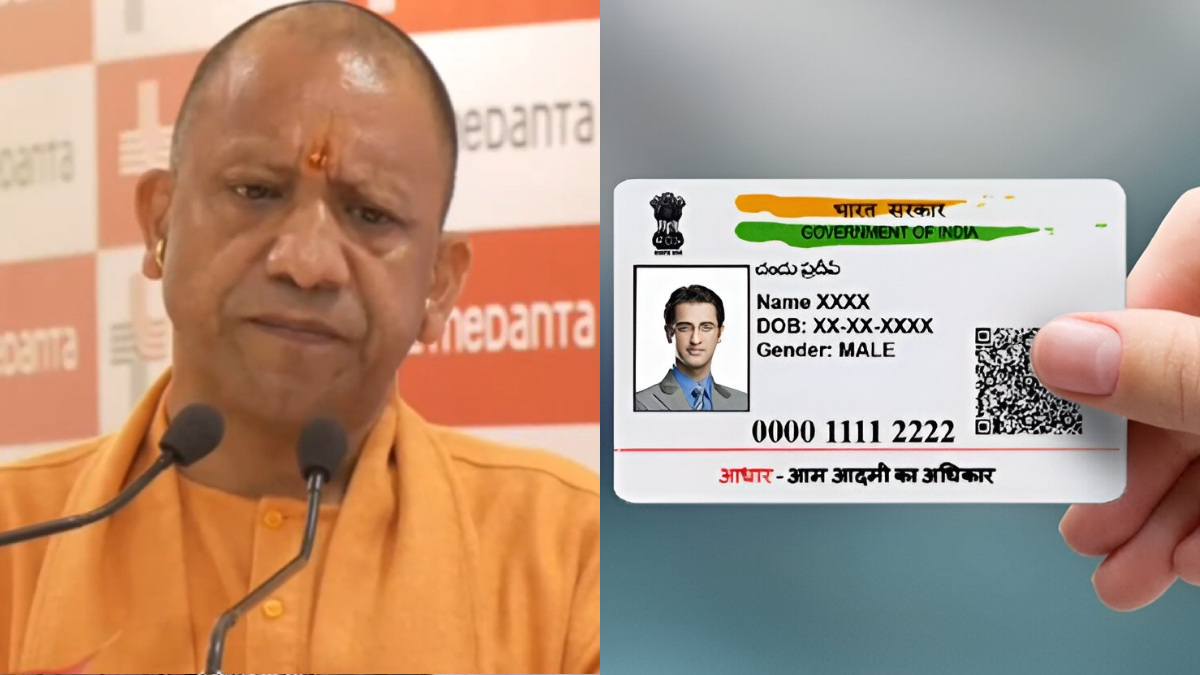

2. PAN-Aadhaar Linking (Final Chance)

While the government has extended this deadline multiple times, December 31, 2025, is currently the hard cut-off to link your PAN with your Aadhaar with the prescribed fine.

-

Consequence: Failure to link will result in your PAN becoming inoperative, meaning you cannot open bank accounts, conduct transactions over ₹50,000, or claim tax refunds.

3. Free Aadhaar Document Update

UIDAI has been providing a window for citizens to update their Aadhaar documents (Identity and Address proof) for free. This facility, specifically for Aadhaar cards issued over 10 years ago that haven't been updated, is set to expire this month. Starting January 1, a fee will likely be charged for these updates at Aadhaar centers.

4. Bank Locker Agreements

Following the RBI’s revised guidelines, banks have been directed to ensure all locker holders sign the new Supplementary Locker Agreement. If you haven't visited your branch to sign the updated contract, your locker access could be restricted starting January 2026.

5. Nominations for Mutual Funds and Demat Accounts

SEBI has mandated that all investors in Mutual Funds and Demat accounts must either provide a nomination or formally "opt-out." Without a valid nomination on file by year-end, your investment accounts may be frozen for debits, preventing you from selling stocks or redeeming fund units.