The Federal Open Market Committee (FOMC) ended its two-day meeting Wednesday by voting to leave the federal funds rate unchanged at 3.5% to 3.75%. The move is a strategic pause, part of a series of three consecutive quarter-point cuts in late 2025, as officials try to reconcile a softer labor market against inflation that stubbornly hovers above the 2 percent target.

The ‘Low-Fire, Low-Hire’ Choice

The Fed posted in its official policy statement that the economy appeared mixed. Economic activity has grown at a “solid pace,” but the labor market has entered “low-fire/low-hire,” according to economists.

- Job Gains: Jobs were anemic at the end of 2025, with December payrolls increasing by just 50,000.

- Unemployment: The jobless rate exhibited “signs of stabilization,” at 4.4 percent at the end of the year.

- Inflation: Core PCE inflation the Fed’s gauge of choice stayed “somewhat elevated,” closing 2025 at around 3 percent, which is still a full percentage point above the long-term goal.

A Divided Committee

The decision was not unanimous, reflecting growing divisions within the central bank. The FOMC voted 10-2 to hold rates.

- The Dissidents: Governors Christopher Waller and Stephen Miran cast dissenting votes, favoring a 25 basis point cut. They argued that the risks to the labor market now outweigh the risk of an inflationary resurgence.

- The Majority: By most accounts, the committee preferred to "wait and see" how earlier rate cuts and prevailing trade uncertainties including potential tariff impacts will play out in the first half of this year.

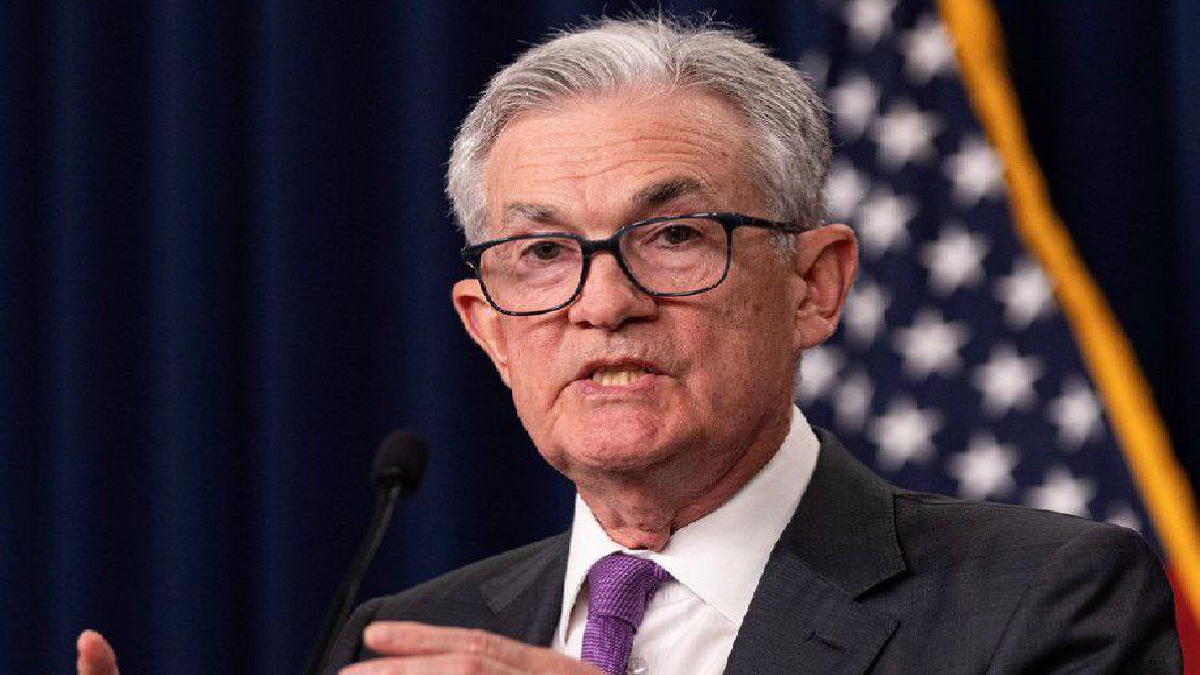

Powell: "Well Positioned" for 2026

In a press conference after the meeting, Fed Chair Jerome Powell sounded a mildly hawkish note about the resilience of the economy. “The economic activity outlook clearly has improved since the last meeting,” Powell said in his comments to reporters. The Fed, he said, is “well positioned” to deal with risks to both those sides of its dual mandate maximum employment and price stability.

Powell also touched on changes in leadership at the Fed, his term is due to expire in May 2026. He said policy remained firmly data-based and protected from the growing political pressure from the White House over direction on future rates.

Market Outlook

Wall Street responded with a muted reaction, as futures traders had already anticipated the “hold.” Goldman Sachs and Oxford Economics analysts now estimate the Fed might stay on hold through the spring, with the next cut not being anticipated until June 2026.