The “fear of missing out” (FOMO) that was at the heart of Bengaluru’s premium real estate market for at least the past two years seems to finally be peaking with respect to financial prudence. In a story that has ignited fierce debate among the salaried elite of the city, a high-earning professional has reportedly ditched a deal for a ₹3.5 crore luxury apartment, opting to forfeit his ₹1 lakh token amount instead of risk a multi-decade debt trap.

The Breaking Point: Job Instability and A Fluctuating Market

The buyer, whose fate was exposed on an anonymous professional networking site, had entered the final stages of a transaction to buy a 3BHK investment in a luxury gated neighbourhood in North Bengaluru. The recent “Black Monday” in early February 2026 – when Indian and global stock indices plunged by more than 4% – prompted a rethink.

The buyer said: “Much of the down payment was placed on Employee Stock Options (ESOP) and personal equity investment and their valuations were shot to the ground in one day. “I understood that if I signed the sale agreement today, I would be having to liquidate my last safety net at the bottom of the market,” the pro asked. “As the current wave of ‘quiet hiring’ turned into ‘silent layoffs’ in the AI-tech sector a ₹2.5 crore loan felt like a noose, not a success.”

The Cost of "Walking Away"

Even though the buyer had paid ₹1 lakh as a token to block the unit initially, the decision to walk away remained difficult. In the present 2026 market, many builders have shifted to non-refundable booking policies once the initial 48-hour "cooling period" is over. But the loss of the lakh to the buyer was viewed by the buyer as a "cheap insurance premium" against financial ruin, in contrast to a potential monthly EMI of approximately ₹2.2 lakh (assuming a 20-year tenure at current interest rates).

A Changing Trend in Bengaluru Real Estate?

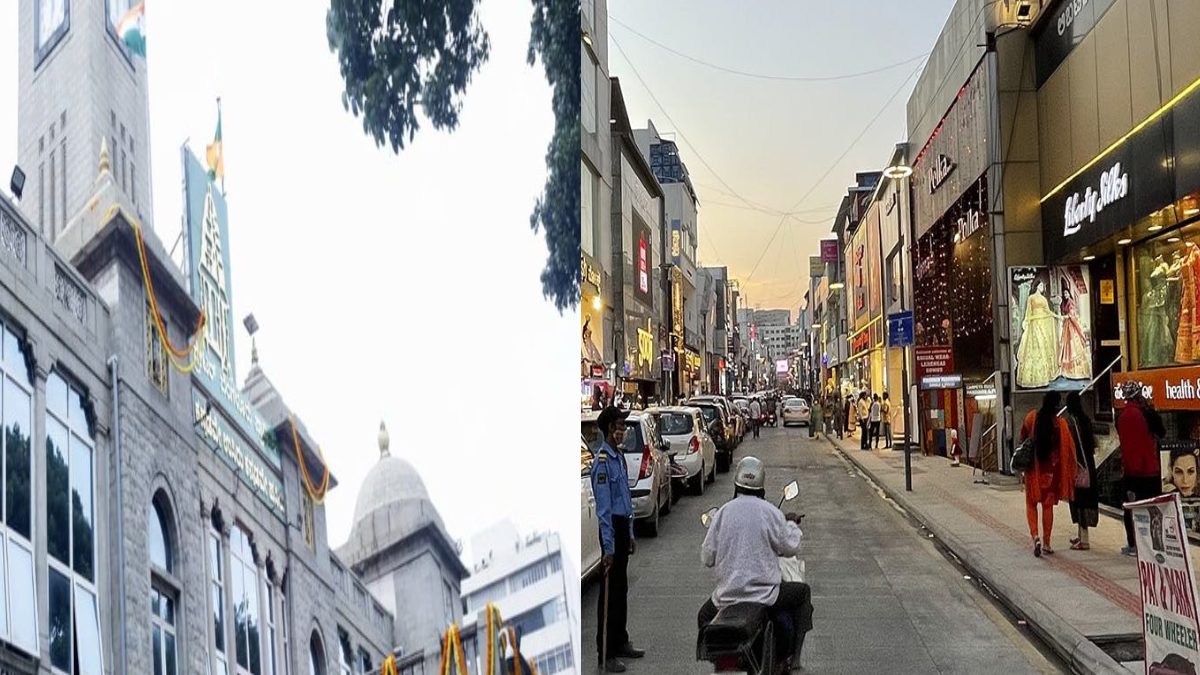

For the bulk of 2025 sales of luxury flats in Bengaluru (above ₹2 crore) broke records. But even as we move into the first quarter of 2026, analysts are perceiving a “wait-and-watch” attitude in mid- to senior-level IT workers. Valuation vs. reality: Although property prices in hotspots like Hebbal and Sarjapur have soared 15-20% on a year-over-year basis, salary growth in the tech space has been relatively subdued in the 5-7% range.

The Stock Market Connection: A large percentage of Bengaluru’s “High-Ticket” buyers rely on market-linked wealth. When the Sensex and Nasdaq catch a cold, the Bengaluru property market begins to sneeze.

Expert View

Real estate consultants suggest that while "deal cancellations" are still rare in the premium segment, the psychology is changing. Buyers are no longer hurrying as a result. “Buyers are not running around so fast,” says a lead analyst at a leading property broker. “They are looking at the developer’s exit clauses, focusing more heavily on the ready-to-move-in ones and less on under-construction projects where higher risks are involved.”

Regarding the anonymous buyer, his post concluded with a blunt comment that struck a chord: “A home is where you feel safest. If the debt is making you feel unsafe, it’s not a home, it’s just an expensive asset.”